Malaysia Benefit in Kind of Cars Table

A motorcar which is provided to the employee is regarded to be used privately if. The BIK value reduce to half if the car is more than 5 years old however petrol remains the same.

Malaysia Passenger Car Sales 2020 Statista

Where the formula method is used the value of the benefit can be reduced if the employee is required to pay a sum of.

. So going back to Questions 1 the benefits on the value of private use of the car and petrol provided is benefit-in-kind and taxable to the person receiving the benefit. INLAND REVENUE BOARD MALAYSIA Date of Issue. Lower of the Two Calculations.

22004 issued on 8 November 2004. These benefits are called benefits in kind BIK. Annual value of BIK Cost of the car to the employer 8 years prescribed lifespan for motorcars x 80.

Motorcar and other related benefits 711. Annual Defined Value. 22 However there are certain benefits-in-kind which are either exempted from tax or are regarded as not taxable.

The tax treatment in relation to benefit-kind BIK received by an employee from his s-in employer for. Motorcar RM Fuel RM Up to 50000. There are several tax rules governing how these benefits are valued and reported for tax purposes.

A Fourth Addendum Page 2 of 4 The annual value of benefits-in-kind on car and petrol for the year of assessment 2007 is computed as follows. 8 NOVEMBER 2004. P11d value is a car valuation that includes VAT and delivery charges but excludes the first registration fee and road tax.

Petrol provided without car 10 10. RM 10000 x 12 x ⅓ RM 40000. Driver provided 10 11.

Where a motorcar is provided the benefit to be assessed is the private usage of that motorcar and the petrol provided. These benefits-in-kind are mentioned in paragraphs 43 and 44 of the Public Ruling No. WLTP Company car BIK rates 2022 - 2025 Current company car BIK rates start at 2 for electric cars 23 for the greenest hybrids and 25 for any car with 100 gkm CO2.

Cost of car when new RM Annual prescribed benefit. 19 April 2010 Issue. If using the formula method to calculate the value of the car BIK an abatement of 20 is given and the formula becomes.

Except where noted in the table the exact CO2 figure is always rounded down to the nearest 5 grams per kilometre gkm. Annual Defined Value of Living Accommodation. Translation from the original Bahasa Malaysia text.

Employees are eligible for most benefits programs on the first day of employment. Motor cars provided by employers are taxable benefit in kind. A further clarification on benefits-in-kind in the form of goods and services offered at discounted prices.

From 14 bands rise in 1 increments to a maximum of 37 with diesel models subject to a 4 supplement should they not meet RDE2 tests. Employers should indicate in the respective EA form the type year and model of the car provided to the employee. 2022 MALAYSIA BENEFITS SUMMARY.

Household furnishings apparatus and appliances 10. Types of benefits-in-kind Based on the formula method RM Based on the. Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee.

For example CO2 emissions of 188gkm are treated as 185gkm. And one should also be aware of exemptions granted in certain. Particular Benefit In Kind 71.

Generally non-cash benefits eg. Employees shall be granted 13 vacation days on a prorated basis for less than 2 years. Accommodation or motorcars provided by employers to their employees are treated as income of the employees.

The benefit in kind tax rate also known as the BIK rate is determined by a variety of factors such as the drivers tax bracket the cars CO2 emissions and fuel consumption and the vehicle P11d value. This is set to rise for the Tax Years 201920 and 202021 with the benefit in kind charge rising to 3430 with the new Van Benefit Charge being 686 and 1372 respectively. 22004 DATE OF ISSUE.

30 of Gross Employment Income under Section 13 1 a RM 6000 x 12 months x 30 no apportionment of ⅓ for this computation RM 21600.

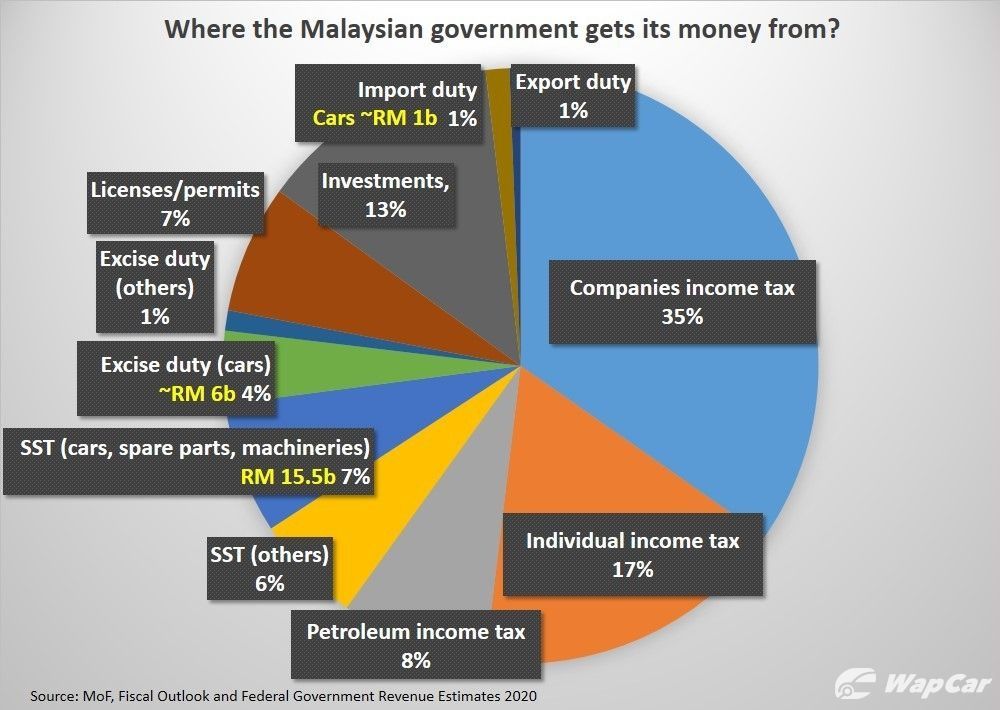

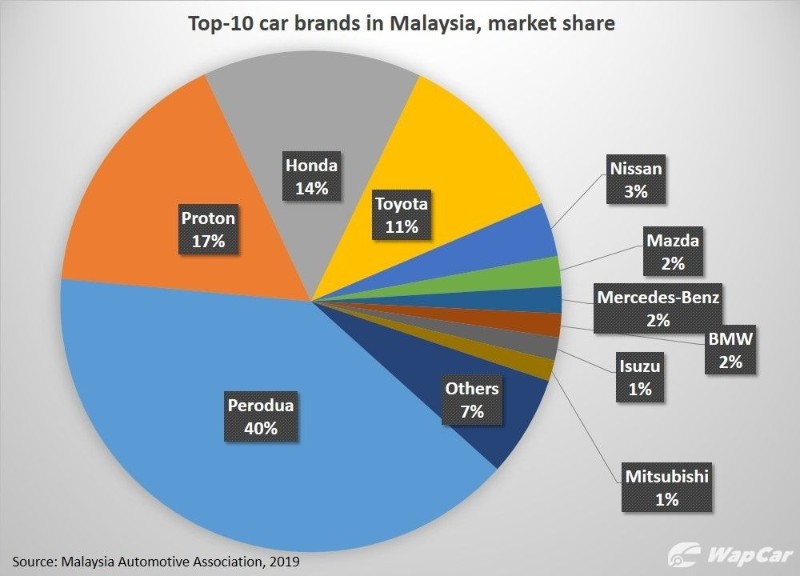

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Company Car Benefit Should I Declare It On My Income Tax Filing

Malaysia Car Sales By Brand 2020 Statista

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

What You Should Know About Car Financing In Malaysia Fortune My

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Comments

Post a Comment